Lending and borrowing is a traditional method that has been used since ancient times. This system helps several people to borrow and fulfill their need for money and the lenders to earn more money using their existing funds. Just like any other system or part of the finance industry, technology has brought advancements to the lending system as well. In the digital era, the process of borrowing has become far faster, easier, and affordable. People can get funds.

Using the benefits of blockchain technology, the system has achieved more security and reliability. Moreover, the individuals can directly fulfill their needs with the P2P platform without the involvement of a middleman in the entire process. Get a secured and innovative P2P lending platform with our expert services.

We offer the solutions for P2P lending platform development, deployed with blockchain technology that eases the entire process of lending and borrowing by eliminating the intermediates.

Our services for the lending platform using the Fiat money offer an edge to attract numerous people to the platform due to the convenience, engaging design, and other commendable features that come with the potential of the blockchain technology.

P2P cross lending platform by our professionals is an ideal choice as it has the features of lending and borrowing Fiat money as well as for cryptocurrencies. This platform is beneficial to attract several people in need of both types of currencies.

P2P platforms have brought solutions to solve some of the existing problems in the traditional lending platforms. The eligibility or the conditions are not required to be checked by the middleman to assign the loan. Instead, there is a programmed system on the blockchain technology that confirms the conditions to verify the eligibility of getting the services. Through this system, the process is accelerated along with being affordable for the users. Smart contracts facilitate both the lender and the borrower to get the privilege of a super convenient system that is secure and quick.

The best part about the blockchain-based P2P lending platform is that the individuals who are able to avail of borrowing services from a bank due to lower credit scores can get the funds from this platform without a hassle.

The deal between the lender and the borrower is fixed with the power of the smart contract which offers an automatic process without involving a middleman. The conditions are checked automatically with the programmed rules.

As the rules and conditions are already coded on the blockchain with the help of smart contracts, there are no chances of human errors in the process that makes the entire process more secure and trustable.

The decentralization facilitates the users with better privacy as they will not have to share their details with others while using the platform. The users just have to choose an appropriate plan of loan and the process will begin conveniently.

The entire process from selecting an amount to be borrowed to getting the funds from the lenders is easier and secure. The P2P system offers a simplified process that can be used without sophisticated technical knowledge.

The monthly interest money and the repayment are calculated easily using an in-built feature on the platform. This feature facilitates both parties to stay updated with the payments that eliminate confusion in calculations.

It is a traditional method of making a perception about someone’s reliability according to the previous record of the loans and repayments. This offers the facility of lending money to trustable individuals only.

Our peer-to-peer platform is integrated with advanced security features enabling a secured environment for the users. The encryption and authentication tools ensure tight security.

Refinancing is a method that allows the users to get a loan sanctioned again from another lender after repaying half the amount of the existing loan on time.

When the amount of the crypto asset of withdrawal has a higher value than a determined amount, the KYC and AML verification is done to ensure the authenticity of the user.

The crypto assets are automatically locked and released securely with the help of smart contracts. The transactions are automated as well when smart contracts are integrated.

Using the secured wallet integrated on the platform, the users are enabled to transfer, hold and receive the cryptocurrency and funds according to their requirements.

The Loan-to-value ratio indicates the amount that will be disbursed to the borrower according to the value of their asset such as property. This feature on the platform facilitates both parties to easily access the value and finalize the amount.

Using a simple option the users can renew their loans. They are not required to offer the book an order or manually indulge in the process all over again.

With the transparent process, the users are facilitated to interact directly without a middleman. The owner of the platform can establish the terms and conditions on the platform according to the need to ensure smooth workflow.

The feedback from the users of the platform enables you to enhance the performance of the platform, alter or add the features, and ensure a user-friendly process.

This feature offers the convenience to the users to find an investment area with lower risks and higher returns. The users are not required to manually search for it.

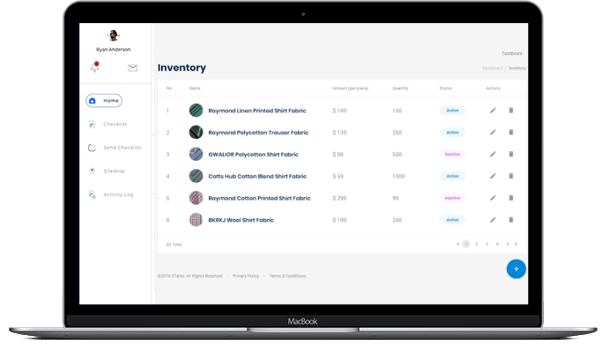

The lenders get the option to find the best match for them by showing them the potential borrowers who need a loan according along with a loan application including the list of the amount of loan, the CIBIL score, and other details.

This feature assists borrowers and lenders to easily access the documents when needed. The borrowers can show their documents to the lenders to less they know about their profile for borrowing money.

This feature offers the option for the lenders to put a restriction on the amount to lend on basis of the documents they have uploaded. The borrowers are facilitated with the feature to figure out the eligibility for a certain amount.

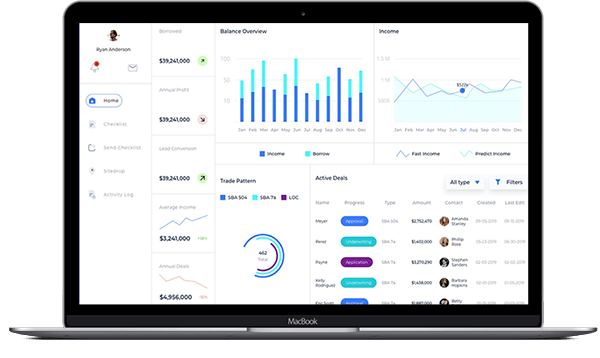

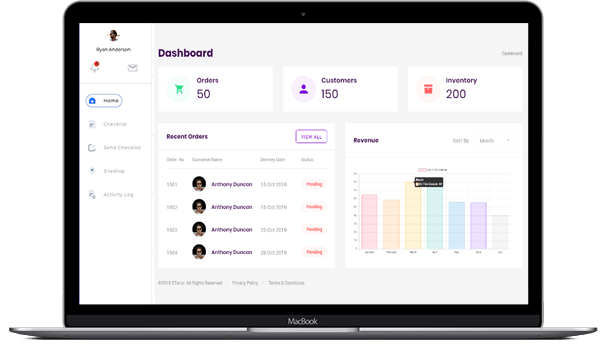

The members of the platforms get a dashboard where they can have access to certain data. The dashboard data of both the lenders and borrowers are different due to their different activities. The users are able to have access to the wallet balance, different states, and loans, and others.

The lenders on the platform maintain the leads, they can follow the repayment status, balance, KYC, and many other options. When the loan is assigned to the borrower, the details are easily accessible by the lenders.

Borrower management allows the users to send an application including all the necessary details such as the amount required, the duration to check the eligibility. When a lender likes the profile, he will notify the borrower about it.

The encryption provided on the platform offers a secured environment for the assets, funds, documents, and other confidential data of the users.

JSON web token is used to protect the data stored on the platform.

The anti-distributed denial of service protects the system from DDoS attacks effectively by ensuring the stability of the platform.

Ensuring the protection of the platform from viruses or other malicious data entering the system.

This feature protects the user's account to be accessed by an unauthorized person.

The system offers protection from the Server-side request forgery attacks to enter and make alternations.

This security feature eliminates the HTTP request to steal or change sensitive data and information.

The users of the platform are assigned a unique identity to be used while accessing the account. The users will know if someone else login through to their account.

Anti-denial service protects the platform from a large number of requests to the server from the attackers and makes sure the platform is available for intended users.

All the lenders who are willing to lend the funds to the borrowers must be creating a profile using the following data in the form. There must be:

The profile creation process is the same as the lenders’ registration process. Here is the list of requirements.

The borrower will send the loan request by adding all the essential details to the profile. The request will be sent to all the lenders on the platform. The process is done using smart contracts.

When the lenders complete their registration on the platform, they get the profiles of the borrowers on the feed. The lenders can get the privilege of accessing the profile they think is suitable.

The matching engine in the platform will set to find the relevant profile and helps to choose the potential borrower and lenders to close the deal. This ensures a secured P2P lending experience that is beneficial to both parties.

After the selection of the profile by the lender, an interaction among both parties will be conducted when both will agree to it. The lender will be able to know the details of the borrower such as:

The process responsible for matching the lender and the borrower has been developed in a way to show the profiles that match with the user’s requirements the most. The P2P lending platform offers a satisfying user experience.

The smart contract automates the process of assigning loans by satisfying the pre-determined conditions and preferences of both the lender and the borrower. Smart contracts facilitate the lenders by separating the borrowers according to their credit history.

When the above-mentioned steps are completed, the lender transfers the money to the borrower. The borrower will now receive his amount and will return the interest according to the decided rate and time.

.png)

Zeligz web store offers solutions for the development of a peer-to-peer lending platform that makes the entire process convenient for the users. Smart contracts enable easy interaction of both parties to accelerate the entire system. We provide expert solutions after analyzing the requirements of the clients and their vision about the platform.

Our professionals of blockchain technology offer flawless services with quality of development and innovation in the design. We deeply analyze your business goals and accordingly develop the solution to ensure accuracy in results. We help you to gain a leading position in the industry with a digital platform that is ready to face success.